How to Choose the Best Payment Method for your E-commerce Store

Confused about the payment method to use on your e-commerce store? You are not alone. There are myriads of payment methods online, which makes it difficult to know the best one for your e-commerce store. You need to choose the best payment method because it can be very risky for your business if you miss it.

There are so many risks involved in payment methods which have made many consumers hesitate to do business online. A survey carried out by Ipsos revealed that 67% of non-online shoppers are concerned about the security of online payments

The choice of your payment solution can impact your bottom line positively or negatively.

You need to choose the best payment methods for your e-commerce store because:

- Not having enough payment methods is one of the contributing factors to abandoned carts. Research by WorldPay also revealed that alternative payment methods accounted for up to 59% of all transactions in 2017. You must be able to use different payment methods on your website.

- People buy more when they did not see their preferred method of payments on your e-commerce website.

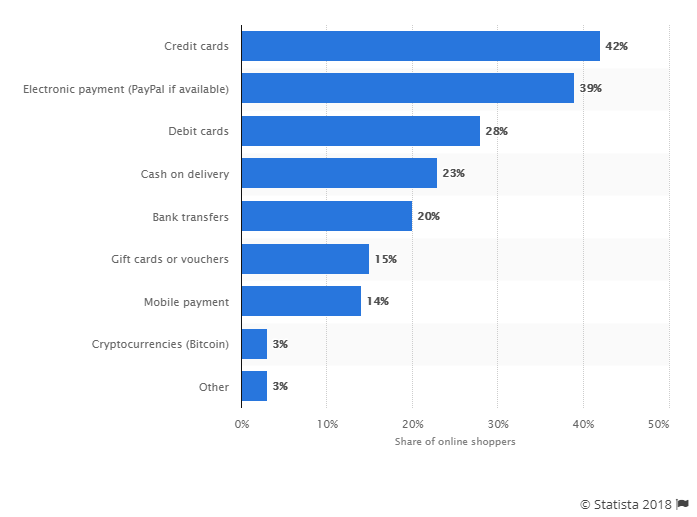

There are quite a good number of preferred payment methods you can use on your website as shown below.

Preferred payment methods of online shoppers worldwide as of March 2017

The question is, which payment method will you choose for your online store?

To do that, there is a number of things you need to consider. They are enumerated below:

5 Things to consider while choosing the best payment method for your e-commerce store

1. PCI DSS Compliant

Ensure the payment processor complies with the Payment Card Industry Data Security Standard (PCI DSS). The PCI DSS is a security standard that is offered by the five biggest credit card companies i.e. The American Express, JCB, Discover, MasterCard, and Visa. This helps to lessen data breaches. You will want to make sure that the payment processor is covered.

2. Effective and efficient fraud prevention systems

According to research carried out by LexisNexis, revealed that e-commerce fraud is on the increase. It is even more prominent on small e-commerce sites that have little to no security in place. Most big e-commerce companies have more protection put in place. The fraud protective factors you should consider are:

- Address verification service (AVs)

- Card Verification Value (CVV)

- Payer Authentication (3D Secure)

- Risk scoring.

3. Minimal transaction fees

Payment processors charge different fees to cover their services. Every time your e-commerce store processes a transaction, you pay different fees. They are:

- Flat rate pricing: This is a fixed percent on all your transaction volume. It does not matter the cost of your product. For example, you can pay 2.9% of the transaction amount + $0.30 per transaction.

- Interchange plus pricing: This is also a fixed rate on the interchange. For example, it can be 2% + $0.10% over a 1.8% interchange fee.

- Tiered pricing: This comprises three different pricing i.e. qualified, mid-qualified and non-qualified. The number of fees you pay on transaction here can be very expensive and it also varies. For example, you can be charged from $2.50 to $3.50.

Some payment processors may also require that you pay setup fees while others built it into each transaction.

Find out the charges your payment processor offers and be sure there are no hidden charges.

4. Geographical coverage and currency

Your e-commerce customer must be able to pay in their preferred currency if you want to make more money, especially if you plan to sell your products or services across the world. Although, as stipulated above, the most common payment methods are credit and debit cards. However, digital wallets and mobile payments such as Apple Pay and Samsung Pay are also becoming popular and this is bound to increase in the coming years. Ensure your payment processors can accept mobile payments.

5. Easy Integration with websites

The payment method you plan to use must integrate easily with your website. Most payment processor such as US PayPal will send your customers to the third-party site to enter their card details and then send them back to your e-commerce store after the transaction. However, you can make it convenient for your customers by integrating it in such a way that they can complete the whole transaction on your e-commerce store.

To make it easy for you to choose the best payment method for your e-commerce store, below are the popular payment method you can use.

7 Best payment method for your e-commerce store

1. PayPal

PayPal is one of the most popularly accepted online payment processor available in different countries of the world. Currently, it has 237 million users all over the world. It is ideal for those who don’t like to input their information into a website. It is structured around payment networks and merchant accounts. Below are its features, advantages and disadvantages and average cost.

Features:

- Availability of custom-made invoices

- Ease of use for customers

- Free to set up

- Available in 200 countries in the world and in 25 currencies

Advantages:

- It is easy to integrate with e-commerce web store

- It has 100% secure checkout

- It allows users to make purchases in different currencies

- It is common and people feel safe using it for transactions

- It has a large user base of about 188 million people

- It makes it easy to serve international markets

- It works on different platforms because it is hosted on a separate website.

Disadvantages

- It is expensive. You may have to pay monthly fees besides transaction fees.

- It charges for on-site processing

- The terms of use are very lengthy and your account can be frozen

- What PayPal deems “obscene” material is not clear and it can stop the sale of specific products they deemed.

Average cost: 2.9% + $0.30 transaction fee.

2. Stripe

Stripe is a fast-rising payment processor that is used by over 100,000 businesses all over the world. It provides the software platform needed to run an e-commerce store. Below are its features, advantages and disadvantages and average cost.

Features:

- Does not require a setup

- Offers coupons and free trials

- Provides Bitcoin Integration

- Instant debit card transfers

- Customizable checkout process

Advantages

- Accepts 100+ currencies in 25 countries of the world

- Accepts six types of credit cards

- Supports Apple pay integration and complimentary developer tools

Disadvantages

- Available in few countries.

- It is expensive

- They only offer email support

Average cost: 2.9% + $0.30 transaction fee. 3.9% fixed international fee.

3. Authorize.NET

Authorize.NET is one of the oldest payment processors online. It was established in 1996. It is owned by Visa, so they have a good experience and reputation. They are planning to release updated integration which is PCI DSS compliant for Magento 2 this year (2018). Below are its features, advantages and disadvantages, and average cost.

Features

- Offers mobile payment integrations

- Free mobile app for users

- Fraud protection tools

Advantages

- It has different security settings and fraud protection systems

- It is owned by Visa, so it is reputable

- It is easy to integrate on e-commerce stores

Disadvantages

- It is very expensive

- It needs many steps to make sure your e-commerce store legally complies

- It needs a merchant account

- It is difficult to transfer e-commerce data should you need to transfer

Average cost

- $2.9% + $0.30 transaction fee

- $49 set up free

- $25 Monthly fee

- $25 chargeback fee

4. Global Payments

Global Payments is known to be a popular e-commerce payment solution. It is a UK based payment solution providing payment solutions to online and mobile merchants to business in the UK and Ireland. It caters for over 14,000 businesses. Realex is known for its expertise and total dedication to good customer service. They have reputable customers like Vodafone, Virgin Atlantic, Party Poker and many others. Below are its features, advantages, disadvantages and average cost.

Advantages

- Accepts all card payment types

- Ability to process transactions in 150 currencies

- A responsive and customizable payment page

- Fraud check systems such as CVN, 3DSecure, and AVS

- Detail order management

Disadvantages

- Its coverage is low. It is only available in the UK and Ireland.

Average cost: £19 per month, 1.75% + 9p per transaction

5. Converge Elavon

Converge Elavon is a flexible omni-commerce payment solution that is secure. It is useful for different ecommerce business such as retails stores, restaurants and service industries.

Below are its features, advantages, disadvantages and average cost.

Features:

- Accepts payment in-store, mail order, telephone order, online or through a mobile device

- Manages recurring and installment payments

- Detailed transaction reports

- 24/7 free support

Advantages

- Accepts a different kind of credit cards such as PIN debit cards, electronic gift cards and mobile wallets (Apple Pay, Android pay, Mobile wallets).

- Ability to write a point-of-sale application with its API

Disadvantages

- Undisclosed fees (hidden fees)

Average costs: $10 per month and 2.65% + $0.19 per transaction

6. WorldPay

Worldpay has existed since 1994 when the internet was still growing. They have a good reputation and experience in the payment solution niche. They have over 150,000 clients in the United States.

Below are its features, advantages, disadvantages and average cost.

Features:

- Mobile payments

- Reporting and analytics tool

Advantages

- Affordable transaction rates

Disadvantages

- A mandatory 3-year contract with a cancellation fee if you want out early

- Lots of charges

- Unreliable customer service

Average cost

- Credit transactions at 1.99% + $0.20

- Rewards credit transactions at 2.6%

- Debit transaction: 0.99% + $0.20 per transaction

7. WePay

WePay is an affordable payment solution that is very fast. With it, you can complete all payment transactions on-site and not on third-party websites. You can accept credit cards, debit cards and direct bank payments on your e-commerce store.

Below are its features, advantages, disadvantages and average cost.

Advantages

- Fast in accepting payments on your website

- Orders and payments are synced making it easy to keep track of your e-commerce store

Disadvantages

- It is only available in three countries of the world i.e Us, Canada, and the UK

Average cost: 2.1% + 0.2 GBP per transaction

Conclusion

Above are the things you need to consider when choosing the best payment method for your e-commerce store and 7 of the best payment method you can use.

If you want to build custom payment integrations, or you need payment extensions to give your customers a unique experience on your website, get in touch with us on info@pronkoconsulting.com message or call +353 85 85 32 401.